Sap depreciation calculation

In Asset accounting the asset value date is very important value field solely because it is the main criteria for calculating the. Depreciation with base method Unit-of-production is calculated as the following logic.

Depreciation Formula Calculate Depreciation Expense

This depreciation calculation method is designed for leased assets that have been capitalized using the capital lease.

. So the system is posting correctly. Depreciation According to the Present Value of Lease Installments. Depr 50000 1 2 10000 1 period factor 2 percentage derived from 15.

Determination of Depreciation start date in Asset accounting. So to find out the details of the calculation you. The depreciation percentage rate is proportional to the remaining useful life.

1 Execute transaction code AFAR and specify parameters only for field Company code and Test run 2 Go to menu. This change will affect the postings and the overall reporting in Asset Accounting as well as the calculation and posting of depreciation. APC - 5600 Accumulated depreciation - 513333.

This depreciation calculation method is. And also the depreciation is posting based on useful life. The only difference in the base method for 0007 and 0011 is that if you select the base method as 0007 then system will calculate the depreciation even after.

Depreciation According to the Present Value of Lease Installments. To prepare for this change in Release SAP S4HANA. Here is the link for p.

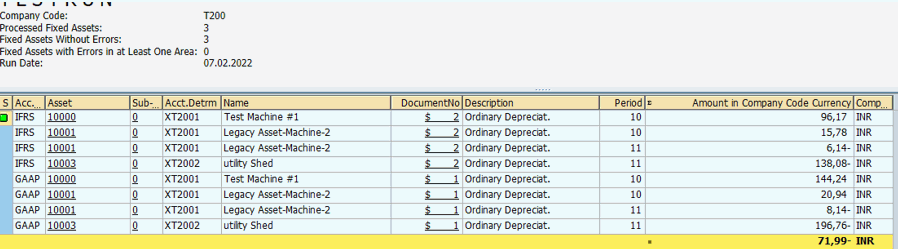

Test Run of Depreciation Recalculation. It is observed that suddenly in a particular fiscal year in the future in period 1 the. Depreciation According to the Present Value of Lease Installments.

If your dep key is based on explicit then that becomes your rate of depreciation if your dep key is based on total useful life then the is derived from total useful life. This depreciation calculation method is designed for leased assets that have been capitalized using the capital lease. The calculation will be.

Depreciation calculation in SAP is the periodic and permanent decrease in the value of the fixed asset over its economic life period because of its usage and associated. Depreciation is not calculated correctly and is unexpectat as per the explicit percentage assigned for the year. As you konw the depreciation for asset should be calculated with the formula Base value period fact depreciation rate.

A detailed explanation with analysis and examples on how SAP S4HANA calculates the Depreciation Values in the asset accounting module. Now suppose i added one more interval for depreciation on 01012011 ie. Acquisition value net book value Total output remaining output Period output.

Different Methods Of Depreciation Calculation Sap Blogs

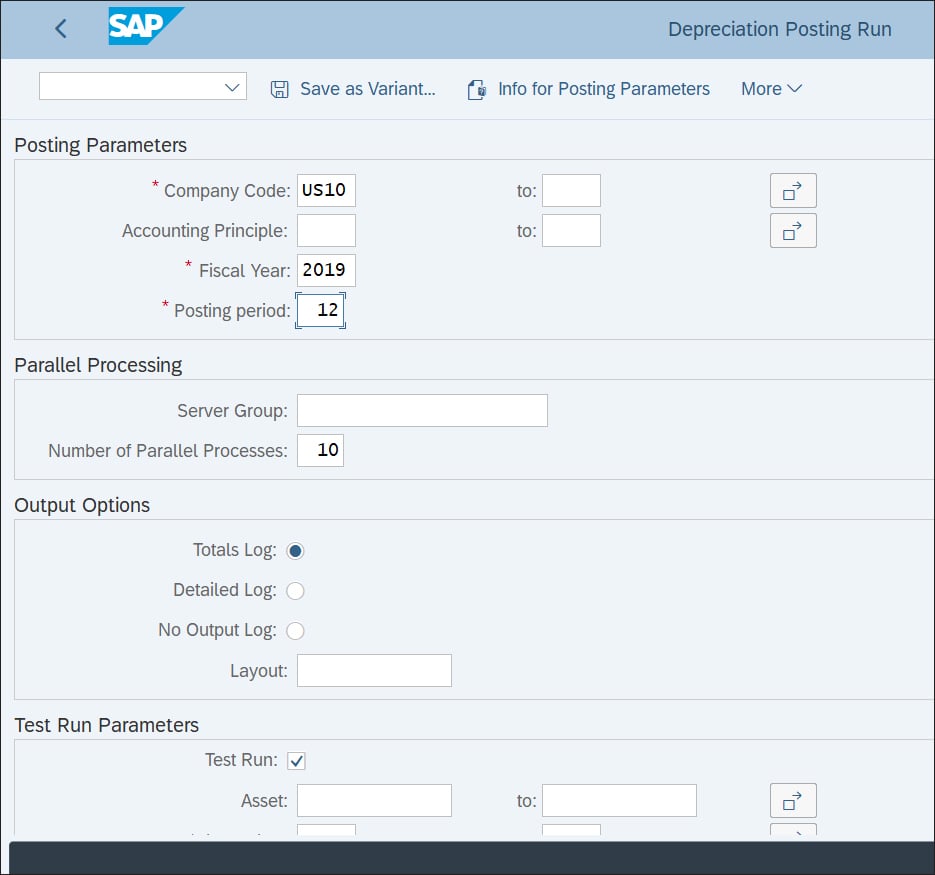

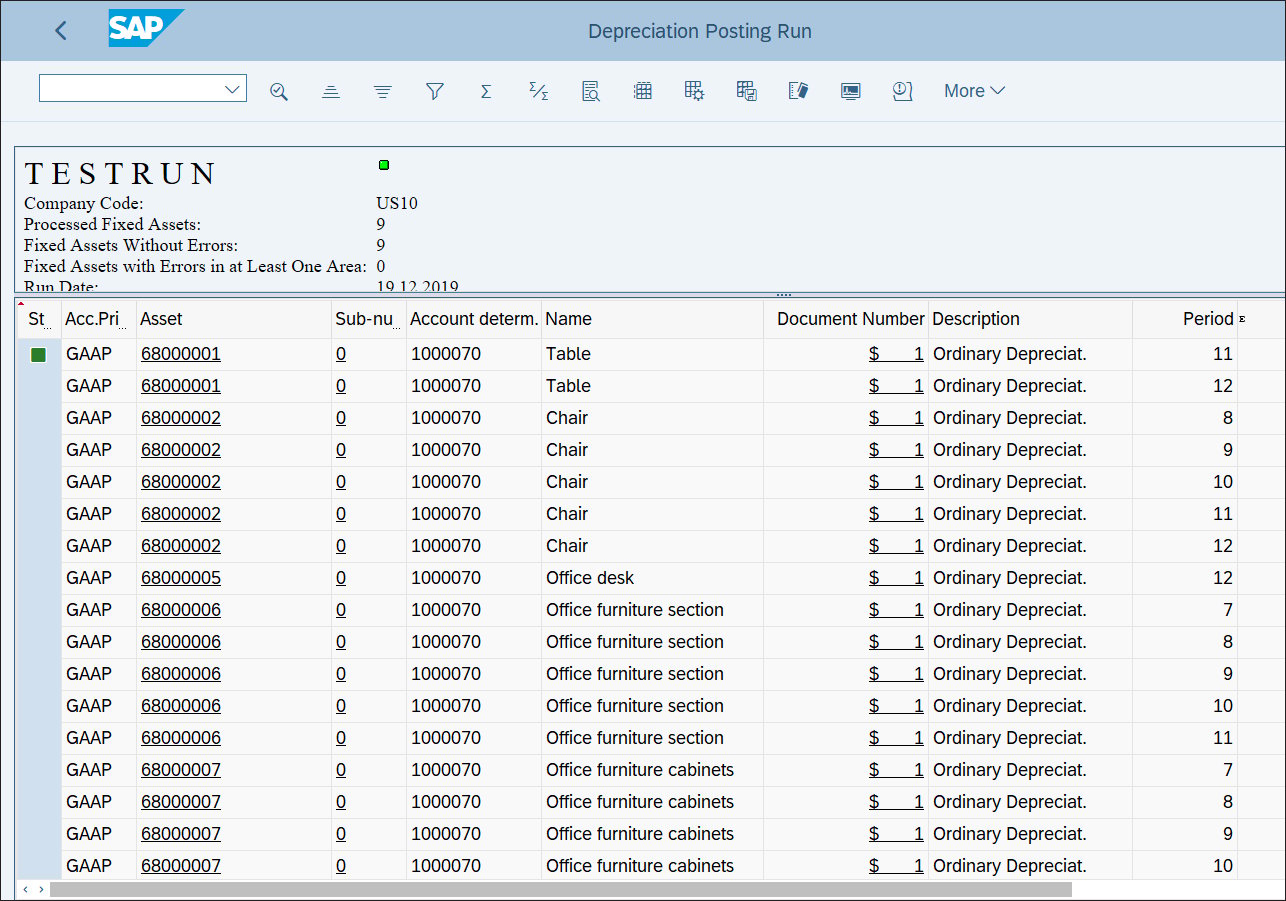

How To Perform Depreciation Runs In Sap S 4hana Finance

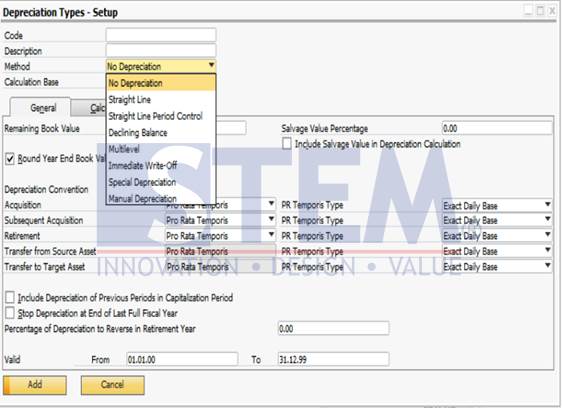

Depreciation Method In Depreciation Type Sap Business One Indonesia Tips Stem Sap Gold Partner

Depreciation Calculation In Sap Methods Types Skillstek

Flyer Design Budget Forecasting Portfolio Design Flyer Design

Depreciation Formula Calculate Depreciation Expense

Different Methods Of Depreciation Calculation Sap Blogs

Asset Accounting Configuration Steps In Sap Sap Tutorial

How To View Depreciation Simulation For Future Number Of Years Sap Blogs

How To Perform Depreciation Runs In Sap S 4hana Finance

Chart Of Depreciation In Sap Overview

Different Methods Of Depreciation Calculation Sap Blogs

Pin On Erp Odoo

Free Professional Balance Sheet Templates In Excel Balance Sheet Template Balance Sheet Excel

Details On Sap S New Depreciation Engine Part 2 Explanation Of Time Intervals Serio Consulting

Different Methods Of Depreciation Calculation Sap Blogs

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement